The Gartley pattern is a famous pattern for trading. The author H. M. Gartley first described it on his 1935 book Profits In The Stock Markets.

The Gartley pattern is a retracement and continuation pattern that occurs when a trend temporarily reverses direction before continuing on its original course.

It gives you a low risk opportunity to enter the market where the pattern completes and the trend resumes.

Options:

Gartley Pattern rules

Buy

Bullish Gartley pattern we have a buy arrow.

Sell

Bullish Gartley pattern we have a sell arrow.

Place your stop loss above/below the previous swing point.

Make profit at the point where price will have retraced 61.8% of the distance between A-D or wit ratio 1:2 stop loss.

Gartley pattern is often used to give trading signals.

Gartley pattern is a price action indicator and can recalculate.

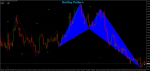

In the pictures Gartley Pattern in action

The Gartley pattern is a retracement and continuation pattern that occurs when a trend temporarily reverses direction before continuing on its original course.

It gives you a low risk opportunity to enter the market where the pattern completes and the trend resumes.

Options:

- The Gartley pattern is similar to the zig-zagging AB=CD

- pattern except that it contains an extra leg at the start.

- Fibonacci levels are used to measure the distance of these legs.

- Time Frame 15 min or higher.

- Financial markets: any.

- Gartley Patterns

- This indicator metatrader 4 is very well identified Gartley pattern.

Gartley Pattern rules

Buy

Bullish Gartley pattern we have a buy arrow.

Sell

Bullish Gartley pattern we have a sell arrow.

Place your stop loss above/below the previous swing point.

Make profit at the point where price will have retraced 61.8% of the distance between A-D or wit ratio 1:2 stop loss.

Gartley pattern is often used to give trading signals.

Gartley pattern is a price action indicator and can recalculate.

In the pictures Gartley Pattern in action